Thanks to Mark Hines of Fidelity Bank for this episode of Tips from the Pros about mortgages.

As expected the Feds raised interest rates 25 bps to 5.25% on Wednesday, noting that job growth has been “strong” and inflation has been close to their 2.0% target. In addition, a larger majority of members (12 up from 8 last meeting) now expect an additional 25 bps hike by year-end and three more hikes in 2019.

The Prime rate is for short term lending like revolving charge accounts and HELOC’s (Home Equity Line Of Credit). This also affects the construction loans that rely on the prime rate as their benchmark.

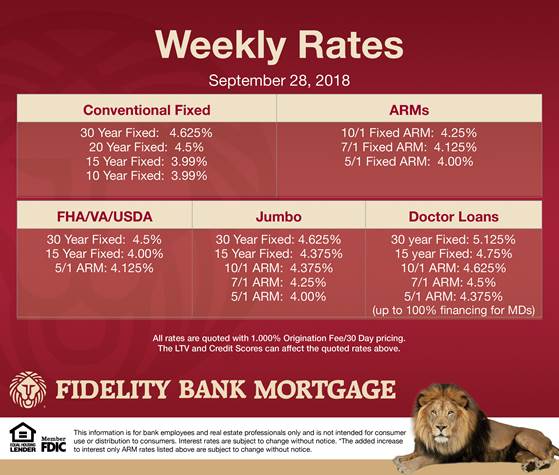

1 Point

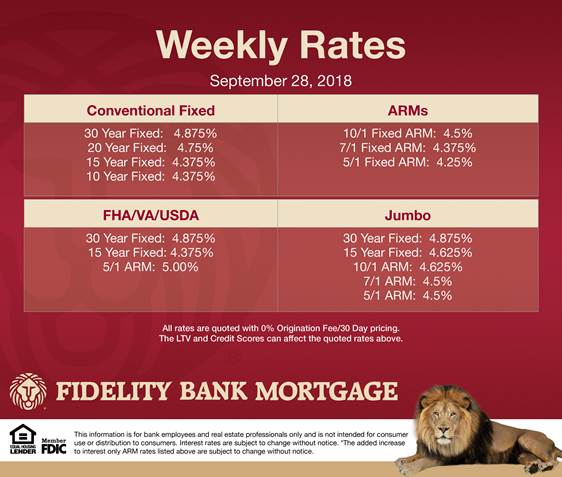

0 Point

In this issue of my Monthly Item of Value, learn good financial habits that will help you throughout your lifetime.

In this issue of my Monthly Item of Value, learn good financial habits that will help you throughout your lifetime.

Having a holiday party this year? Party planning can be a nightmare, trying to put all of the pieces in place. Most people who plan events don’t have a chance to enjoy them because of the work involved.

Having a holiday party this year? Party planning can be a nightmare, trying to put all of the pieces in place. Most people who plan events don’t have a chance to enjoy them because of the work involved.

Recent Comments