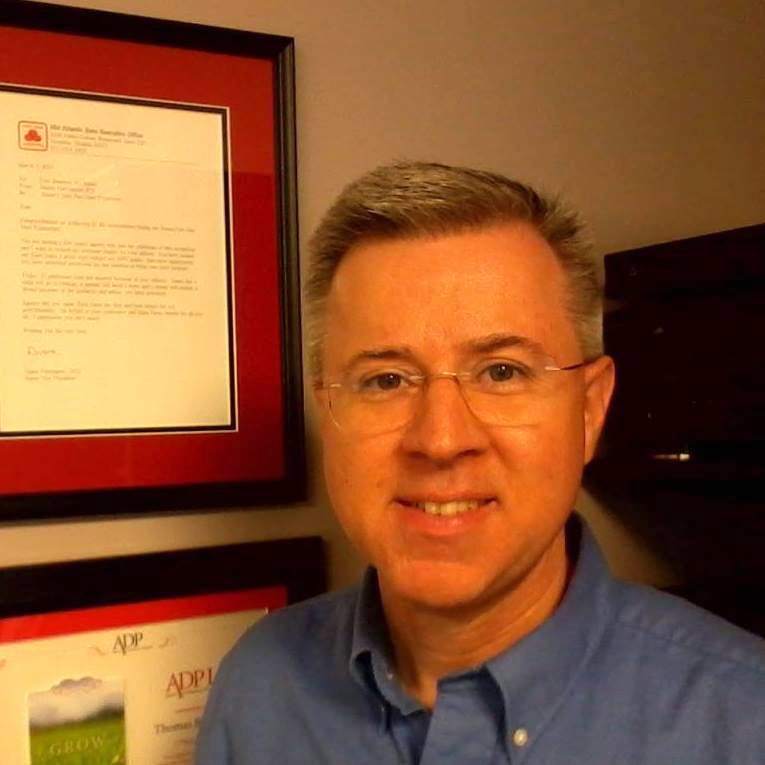

Tom Benisch, Jr., CPCU, LTCP, Agent at State Farm

This series of posts will introduce you to my team of preferred partners who assist me in all aspects of my business. In this installment, meet Tom Benisch, Jr. of State Farm. When I say I am your trusted real estate adviser and that I’m available to provide resources/referrals to other industry professionals and services before, during, and after a sale, I mean it.

What is your mission statement or philosophy of business?

MISSION: Our mission is to impact & improve the quality of our clients’ insurance programs & financial portfolios as well as help our clients manage the risks of everyday life, recover from the unexpected and plan for their futures.

VALUES & PHILOSOPHY:

- Treat & talk to everyone we come in contact with the way we want to be treated & talked to.

- Educate our clients as to their options.

- Make people feel special on every interaction.

- We will ALWAYS do the right thing for our clients.

Tell us something about yourself. Maybe something interesting from a previous work life, something that has shaped your philosophy.

I began my career at State Farm over 34 years ago working in State Farm Auto Claims. One of the many things I learned from working auto claims for 14 years is that most people don’t learn about their insurance until they have a claim. Claim time is not the best time to learn about the details of one’s insurance as whatever coverage you have at the time of your claim applies.

Let’s face it, insurance is not real exciting and is never that important until one needs to make a claim. No one teaches you about insurance in school. At the Benisch Agency, we offer reviews to our clients every couple years and help educate our clients as to their insurance options so their insurance can change as their life changes.

During our client reviews, we review coverage they carry through their employer group benefit plans and any individual policies they may own. Our job is to help our clients have well-coordinated insurance plans. We help our clients identify duplications and gaps in their coverage which can cost them money. Additionally, we make suggestions to help our clients best protect their families, incomes and assets.

Share a recent success story or a story you’re really proud of. Could be industry related or something outside of business.

The practice in my agency, is to offer our clients reviews every couple years so our client’s insurance policies keep pace with the changes in their lives. Not all of our clients take advantage of this service.

This is a great story of one of our clients that did meet with us regularly. We’ll call this client – Client A.

I met Client A about 20 years ago. At that time, Client A was about 22 years old with few assets and income to protect. And the client carried reasonable auto liability limits to fit his budget. This client met with us every few years to review his coverage with us.

Client A met with us a few years later. He acquired a good income paying job making a great deal more than his prior position. This client opted to increased his auto liability limits to better protect his assets and his good paying income.

Client A’s story could be like yours

Years later, Client A married and purchased a home and agreed to meet with us again to review his insurance. When we met with Client A, we learned about his & his wife’s assets and incomes. We recommended a Personal Liability Umbrella Policy to Client A to best protect his and his wife’s assets and incomes. A 1 Million Personal Liability Umbrella Policy from State Farm was purchase by Client A. At that time, Client A’s cost for the Personal Liability Umbrella Policy was under $150 for the year.

A few years later, Client A was involved in a very serious auto accident that was clearly his fault. Two years later, Client A was served lawsuit papers where he was being sued for 3.5 Million. The claim was very complicated as the injured party had a unrelated condition that was worsened from this serious car accident. State Farm Claims settled the claim for 1.1 Million where Client A had ZERO out of pocket expenses.

Thank God Client A met with us every few years to review his insurance. My Client A made some good choices to make adjustments to his insurance to best protect his and his wife’s assets and incomes. Had he not allowed us to meet with him for insurance reviews and he left his limits at the same limits he carried 15 to 20 years ago, State Farm Claims would have never been able to settle his claim. Most likely, he would have been forced to liquidate his assets and have his wages garnished.

Freestyle — anything else you would want people to know.

We’re always happy to be a resource for our clients, their friends, families and others they care about. Feel free to contact us for an honest second opinion on your insurance or if you ever have an insurance question where we can help.

Recent Comments