Inflation

Thanks to L. K. Benson for sharing this blog about inflation.

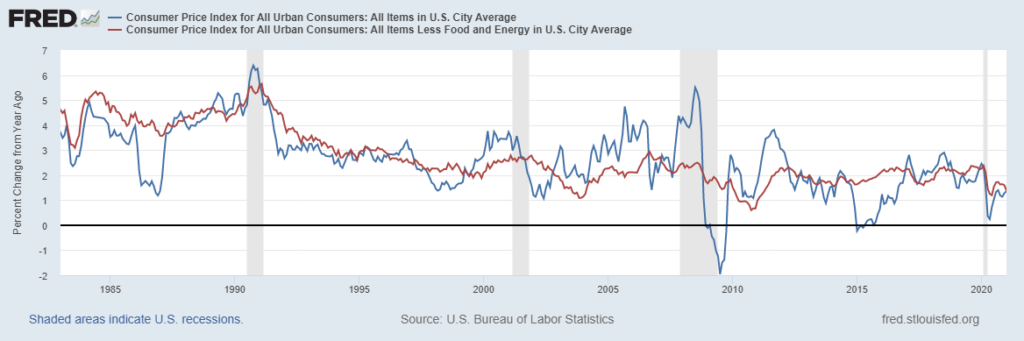

Inflation is an important financial concept to understand and has always been a critical factor in our long-term financial planning analysis for clients. It can be difficult to grasp how rising prices erode the purchasing power of your cash when the inflation rate is low and you don’t see and feel the effects of prices rising on a regular basis. That is exactly the environment we have been in for almost forty years, which can be seen clearly in the following chart:

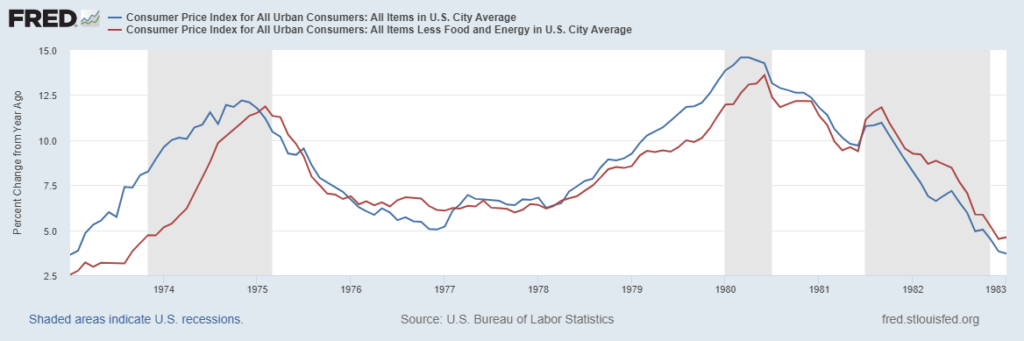

From 1983 to 2021, you can see a downward trend in the Consumer Price Index (CPI), which is the most frequently cited measure of inflation. The average CPI over that time was around 2% and it rarely spiked very high above that. This period followed a decade in the 70’s and 80’s where inflation soared and never even got down to that 2% level:

This year is the first time since the early 80’s that we have seen a surge in inflation and we can see it everywhere. The first place most people notice it is at the gas pump, where the national average price of a gallon of gas recently hit $5 for the first time ever. Let’s look at how we got here, where we might go next, and any actions you should take.

How We Got Here

It is usually difficult to determine the root cause of inflation and economists and politicians love to argue over this to support their preferred way to solve the problem. However, this recent bout of inflation looks fairly straightforward, especially if you understand the basics of Economics 101 and the supply/demand curve:

- Less Demand, Lower Prices – We had a global pandemic that shut down economic activity in 2020. We all stopped driving places, going to restaurants, shopping in stores, traveling and more. This led to less demand and lower prices.

- More Supply, Lower Prices – As a result of the halt in economic activity, we suddenly had too much supply of many things, like oil. The price of oil plunged in the early days of the pandemic, with crude changing hands at negative prices at one point!

- More Demand, Higher Prices – Countries around the world responded to the pandemic by slashing interest rates and pumping money into the system, especially in the US, where we issued multiple rounds of stimulus checks.These monetary actions, along with the forced savings during lockdowns, drove demand higher for goods as millions of people suddenly had extra cash to spend.

- Less Supply, Higher Prices – At the same time demand was starting to spike, manufacturers were having trouble keeping up with orders as factories were shut down due to COVID. There were shortages of many inputs in the manufacturing process, like semiconductors, and that led to a shortage of all kinds of products.

- More Demand AND Even Less Supply, Really High Prices! We entered 2022 with inflation rising but the Federal Reserve continued to use the “transitory” label, hoping things would gradually settle down and get back to normal without them having to take drastic action. Then, Russia invaded Ukraine, which significantly reduced the global supply of critical commodities like oil, grains, wheat and fertilizer. These are all key inputs to many different areas of the manufacturing process and as the prices of these commodities rose higher, so did the prices of the end products.

Of course, it’s not this simple and there are many other factors that have contributed to the current bout of inflation. However, these were some of the key factors and when you step back and consider what we’ve been through since 2020, it’s no wonder we are seeing high inflation!

Where We Go Next

The only correct answer to where we go from here is that nobody knows. Read enough economic reports and market commentaries from experts and you’ll have predictions ranging from hyperinflation to deflation. Instead of trying to guess who is correct, let’s look at the range of possibilities, along with my guess at the probabilities of each:

- Hyperinflation (50%+) – 0% Probability – There have been plenty of people over the past year who have warned the US was entering a period of hyperinflation. The definition of hyperinflation is a rise of over 50% per month. We’ve seen this before, with the most recent example being Venezuela but maybe the more famous being Zimbabwe, who printed the Hundred Trillion Dollar bill seen above. I won’t get into the many reasons why the US is different from other countries that have experienced hyperinflation, but let’s just assume this is a longshot here.

- High Inflation (6-15%) – 15% Probability – This is where we are right now with the current CPI over 8%. The Federal Reserve has started to aggressively raise interest rates and seems committed to doing everything it can to slow down inflation. However, there is no guarantee they will be successful and if the war in Ukraine drags on or even expands further into Europe, or we see some other shock to the system, the pressure on commodities prices could keep inflation at an elevated level.

- Above Average Inflation (3-6%) – 35% Probability – The Federal Reserve target for inflation is 2% so anything in this range would be higher than they’d like to see. However, once inflation gets into the system it can be very hard to break, especially when interest rates are their primary tool. If price increases lead to wage increases, they could lead to further price increases and the self-perpetuating cycle becomes difficult to stop. This level of inflation might not seem so scary compared to the current 8% rate, but if we stayed at this level for an extended period of time it would have a dramatic impact.

- Average Inflation (1-3%) 25% Probability – This is where the Federal Reserve would like to see inflation over the long-term, but it could take a while to get back here. The quickest way to get us back to this level would also be the most painful – driving interest rates up so high they induce a recession.

- Deflation (<0%) – 25% Probability – We are already seeing some signs of a slowdown in the economy at the same time the Fed is hiking rates at the fastest level in years. The combination of the two could lead us into a deeper recession, a possibility Cullen Roche details here.

What You Should Do Now

As we often tell clients, the best advice we can offer is usually “Don’t just do something, stand there!”. We continue to believe the best long-term investment strategy is to remain diversified, rebalance periodically, and ignore the short-term volatility. It’s impossible to predict where inflation will go from here, and even if you could accurately predict inflation, you’d then have to predict how it will impact various asset classes. Stocks have historically been an excellent inflation hedge over the long term and despite this year’s market decline, we believe they will continue to be the best way to hedge against inflation in the future.

While we don’t recommend making any drastic changes to your portfolio in light of the current inflation environment, there are some things you should consider in your personal financial planning right now:

- Determine Your Personal Inflation Rate – The biggest key to your retirement planning success is what you spend. We believe it’s always important to monitor your spending, but it’s even more important with inflation so high. A colleague of ours put together this spreadsheet that you can use to help calculate your own personal inflation rate. Is it higher or lower than the actual inflation rate?

- Monitor your Lifestyle Inflation Rate – I called this “Beerflation” in a post a few years ago and it refers to our tendency to buy nicer things as we get older and our income increases. This can lead your personal inflation rate to spike higher even during times of low inflation in prices, but it can also work in reverse. If inflation continues at the current rate, you might be able to minimize the impact by taking your lifestyle inflation backward. Maybe you go back down from high-end craft beers to something slightly less expensive, or instead of splurging on a fancy hotel, you stay in a less expensive Airbnb on your next trip.

- Delay Social Security – This might seem counterintuitive because if you have been delaying social security you might need that extra income now more than ever. However, each year you delay benefits you earn about 8% in additional delayed retirement credits AND your social security benefit amount increases each year with inflation. A guaranteed 8% return plus inflation protection is tough to beat elsewhere.

- Reassess Your Cash Reserve – We always think it’s important to keep a cash reserve, especially after you enter retirement and begin drawing down on your portfolio. If your spending has increased, you might need to increase your cash reserve as a result. With rates rising significantly this year, you should also look at where your cash is being held and see if you might be able to earn a higher rate in a savings account or even in short-term treasuries or CDs.

When it comes to your portfolio, we understand that sometimes it feels better to just “do something” when we are faced with an economic situation like this. If that’s how you feel, we recommend making that “something” small so it won’t materially impact your long-term plan if it’s wrong. Here are some of the asset classes that might do well in a high inflation environment, along with thoughts on each:

- Series I Savings Bonds – These are inflation-linked government bonds that are currently paying over 9% and are the place to start if you have excess cash on hand. The rate adjusts every 6 months based on inflation so as long as inflation remains elevated they are an excellent option. Unfortunately, you can only purchase $10k per year per individual (plus $5k from your tax refund) and you have to purchase them directly through the Treasury Direct website. Also, be aware that you have to hold them for at least a year and if you liquidate them before 5 years you forfeit 3 months of interest.

- Treasury Inflation-Protected Securities (TIPS) – We typically include TIPS funds in a diversified portfolio as they can be an excellent hedge against long-term inflation. However, their price tends to rise in advance of inflation as the market prices in potential future price increases. This can lead to strong performance before a bout of inflation and lagging performance during the actual inflation period. As it can be impossible to accurately time these moves, they should only be added to the portfolio as a long-term holding.

- Real Assets – Physical assets like real estate, commodities, precious metals, natural resources, and infrastructure generally do well during times of inflation. Unfortunately, some of these asset classes will go through very extended periods of underperformance compared to the rest of the market and that can lead many investors to give up on them at exactly the wrong time. If you think you have the mental fortitude to stick with an asset class like that, you might consider adding a small allocation to one or more of these asset classes, if you don’t already have exposure to them.

- Liquid Alternatives – These are generally hedge fund strategies that have made their way into more mainstream investment vehicles like mutual funds and ETFs. These include strategies like Long/Short Equity, Market Neutral, Risk Parity, and Managed Futures. These can be complicated and confusing strategies with high fees so we generally don’t recommend them as a core holding. However, their fees have become more reasonable in recent years and many of these funds have shined during the recent downturn, showing the benefit of owning noncorrelated assets. Adding a small allocation here could qualify as “doing something” without too much downside risk.

We understand how scary the market environment looks right now with stock prices falling, bonds losing value as rates rise, and inflation continuing to march higher. We are here to help guide you through challenging times like this so please don’t hesitate to reach out if you’d like to discuss your current financial situation.

-Chris Benson, CPA, PFS

The views expressed represent the opinions of L.K. Benson & Company and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person.

Please see Additional Disclosures more information.

In addition, if you are interested in buying or selling your home, contact Gigi today. Oh by the way… I’m never too busy for any of your referrals!

Recent Comments