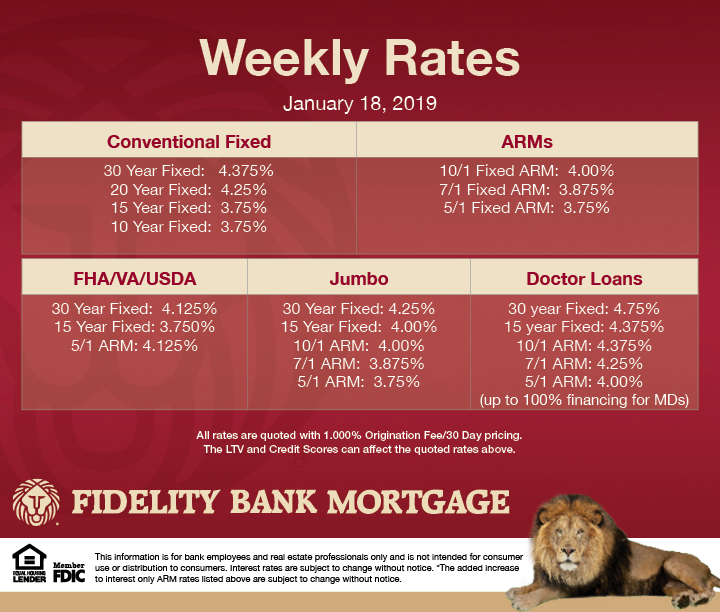

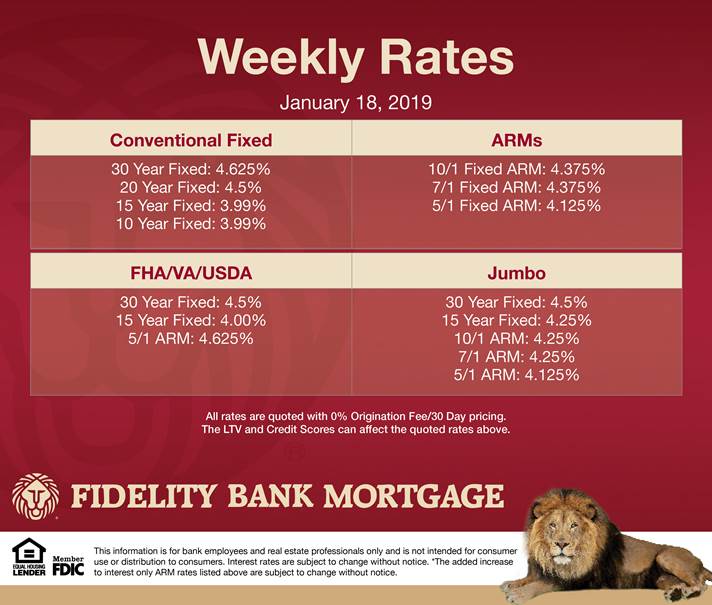

Thanks to Mark Hines of Fidelity Bank for this episode of Tips from the Pros about mortgage rates.

Don’t forget Fidelity Bank Mortgage now has the lock and shop to insure the rate does not go up while searching for the home of their dreams. See attached.

Long term trend provided by Market Alert, Inc.

Some may be wondering where all the furloughed government workers claims for jobless benefits are? As is normally the case with federal workers — they have a different system than the average Joe on the street. There are more than 10,500 government employees who have sought benefits through the week ended January 5th, the latest period for which numbers are available.

The federal jobless benefits are higher than those paid to ordinary citizens – but unlike regular citizens – federal workers are required to pay the money back. The President signed a bill yesterday that provides a mechanism for federal workers to recover back pay.

May calmer, cooler heads put aside partisan interests and do what is in the absolute best interest of all Americans. My comment here is without political bias or agenda – it is simply presented to make sure you are aware of developing conditions in the credit markets that could have negative consequences for you and your clients.

As they have been doing over the past several weeks – mortgage investors are pacing the floor and wringing their hands worrying about everything from the economic impact of the most extended government shutdown in history – to the unfriendly influence the massive amount of government debt scheduled to avalanche into the U.S. credit markets this year will probably have on the trend trajectory of mortgage interest rates. There is more than enough here to make mortgage investors very hesitant to nudge rates notably lower from current levels.

Contact Gigi today if you are interested in buying or selling a home.

Recent Comments